This post will get very personal, in a sense that I will be more and more writing about my personal trading, and how I archived profit in forex. So take a deep breath and continue reading !

I believe they are 2 good maxims in forex trading and trading in general. The trend is your friend and buy low sell high. Both makes sense, and both are actually true. But if you think about it, one of them is more logical than the other. The trend is your friend makes sense because if you are buying, you want other people to be buying too, so price goes up, and you will make a profit. But that also means that you bought at a lower price, and that the trend, well.. wasn’t there yet. How you knew price was going in your direction is then a little magical.

Buy low sell high is different. I see it as a ode to contrarian trading because on a second thought it means that the lower the price is, the bigger your potential profit can be (for a long example). Now things get a little personal. Contrarian traders are smart, and they will look for spikes entries. A spike offers you the perfect opportunity because it is an irregular movement of the price, and it gives you a very good risk/profit ratio. If price pops up by 20 pips suddendly, you will be looking to sell high (short), and buy low (cover). Of course a lot of technical conditions should be taken into consideration, such as support & resistance, but you see my point.

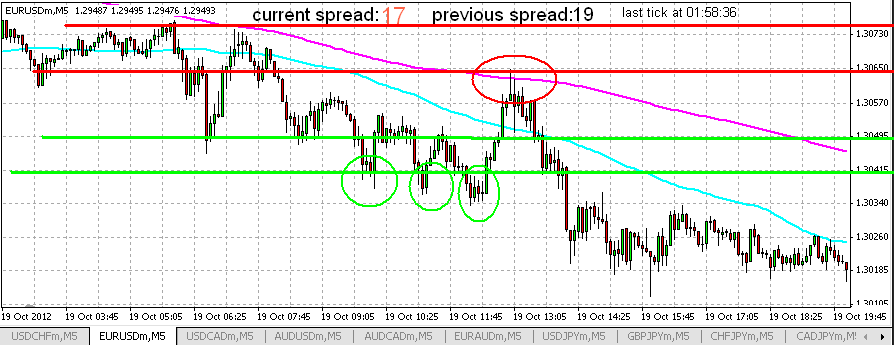

Now let’s look at a random chart example on EURUSD .in 5minutes candles.

The 2 horizontal green lines represent the support zone. Why 2, well because I believe you cannot pinpoint a support, and see it more as a “demand zone”. I will make another post about this later ! Anyways the 2 horizontal red lines are resistance zones. I circled in green the price testing the demand zone. If no majors news are expected, and stock movement is flat / nothing special (I will also make another post about the correlation between stocks and currencies !) , then that would be a contrarian buying opportunity. As you can see in these 3 cases price went quickly up after that.

I also circled in red a contrarian short opportunity. Notice that in all those circles, there is always a spike of the price, also called a “wick”. When you are looking at the charts with candlesticks, that basically means there was a quick movement of the price AND THEN a quick retracement. Thats usually an indicator of reversal. Now I said in many other posts that a successful trader will spend most of his time waiting for an entry, and then for an exit. Now we would be waiting to take a contrarian entry on the wicks. The beauty of this is you usually turn green (in profit) almost instantly.

That’s all i got on my mind for today, but I will be updating this post probably this week. If you have any questions/comments , feel free to post below !

I just recently came across

I just recently came across